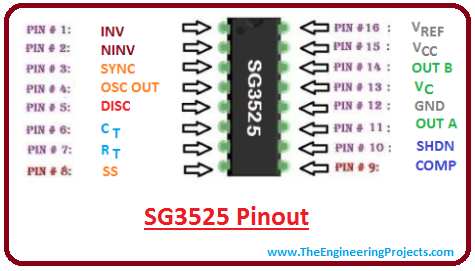

Sg3525 Compensation Calculator

Hi, I am designing a 0500V (25mA) power supply based on the SG3525.The input is a 12V battery. The transformer was designed using the software available from Vladimir Denisenko, available on this site. The problem I am facing is that I am getting no output from 0100V (00.5V setting) and then it maxes out at 400V.

- The amount of basic benefit paid ranges, depending on how disabled you are. VA makes a determination about the severity of your disability based on the evidence you submit as part of your claim, or that VA obtains from your military records. VA rates disability from 0% to 100% in 10% increments (e.g. 10%, 20%, 30% etc.).

- Sg3525 is certainly a voltage mode PWM controller integrated routine. It is definitely used in optimum inverters obtainable in market. Actually best inverters manufacture companies also make use of Sg3525 in dc to dc converter component of the inverter. It is a 16 pin incorporated routine.

How do I calculate the maximum amount I can borrow?

The following methodology, which is one of the methodologies contained in the CARES Act, will be most useful for many applicants.

Step 1: Aggregate payroll costs (detailed below) from the last twelve months for employees whose principal place of residence is the United States.

Step 2: Subtract any compensation paid to an employee in excess of an annual salary of $100,000 and/or any amounts paid to an independent contractor or sole proprietor in excess of $100,000 per year.

Step 3: Calculate average monthly payroll costs (divide the amount from Step 2 by 12).

Step 4: Multiply the average monthly payroll costs from Step 3 by 2.5.

Step 5: Add the outstanding amount of an Economic Injury Disaster Loan (EIDL) made between January 31, 2020 and April 3, 2020, less the amount of any “advance” under an EIDL COVID-19 loan (because it does not have to be repaid).

The examples below illustrate this methodology.

Example 1: No employees make more than $100,000

- Annual payroll: $120,000

- Average monthly payroll: $10,000

- Multiply by 2.5 = $25,000

- Maximum loan amount is $25,000

Example 2:Some employees make more than $100,000

- Annual payroll: $1,500,000

- Subtract compensation amounts in excess of an annual salary of

- $100,000: $1,200,000

- Average monthly qualifying payroll: $100,000

- Multiply by 2.5 = $250,000

- Maximum loan amount is $250,000

Example 3: No employees make more than $100,000, outstanding EIDL loan of $10,000.

- Annual payroll: $120,000

- Average monthly payroll: $10,000

- Multiply by 2.5 = $25,000

- Add EIDL loan of $10,000 = $35,000

- Maximum loan amount is $35,000

Example 4:Some employees make more than $100,000, outstanding EIDL loan of $10,000

- Annual payroll: $1,500,000

- Subtract compensation amounts in excess of an annual salary of

- $100,000: $1,200,000

- Average monthly qualifying payroll: $100,000

- Multiply by 2.5 = $250,000

- Add EIDL loan of $10,000 = $260,000

- Maximum loan amount is $260,000

What qualifies as “payroll costs?”

Payroll costs consist of compensation to employees (whose principal place of residence is the United States) in the form of salary, wages, commissions, or similar compensation; cash tips or the equivalent (based on employer records of past tips or, in the absence of such records, a reasonable, good-faith employer estimate of such tips); payment for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums, and retirement; payment of state and local taxes assessed on compensation of employees; and for an independent contractor or sole proprietor, wage, commissions, income, or net earnings from self-employment or similar compensation.

Sg3525 Compensation Calculator 2019

PPP Loan Calculator provided and powered by SBA.com®

Source: https://home.treasury.gov/system/files/136/PPP–IFRN%20FINAL.pdf